Welcome to

the

Club

Active members in the club

Renewal rate average since club establishment

Average membership duration

Industries represented

Average GDP contribution

Alumni

Employees our members lead

Nationalities

We connect

exceptional

People

Panorama

A concept of 3 simultaneous meetings on different topics, with a maximum of 20 people per meeting, followed by a networking session to discuss topics ranging from business to culture.

LEARNING

Breakfast

for Thought

Feed your thoughts by part-taking in quality discussion, over breakfast, based on an inspirational TED Talk video suggested by the Clubs’ Members.

EXPERIENCE

Power

Lunch

The city’s most exclusive lunch, that starts by interviewing a Member followed by an open discussion.

RELATIONSHIP

Supported

Events

Events organized by the Clubs’ Partners or third parties and supported by the Club. Offering benefits to Members such as VIP invitations and special offers/rates.

OTHER

Open Air

Cinema

Annual July gathering, where Members and their spouses enjoy a secret movie under the starry night.

FUN & SOCIAL

Benefits of

being a

Member

CEOs don’t have to be alone

Meaningful networking means long lasting, honest relationships, based on trust and respect. Its who we generate value with that matters, not how many people we know.

CEOs don’t need to know everything

Combined, their peers do. The Club provides the platform that helps leaders building the relation needed so they will share their own successful or not so successful experience with their peer when needed.

CEOs don’t have to prove anything to each other

In such a circle everyone’s successful. We invite your true, simple and humble self in. We value our Members for who they really are.

Interested in being part of

Our

Comunity

Members of one Chapter are automatically Members of other Chapters globally.

The Membership of CEO Clubs is personal and by invitation only.

SuperBrains of Romania

Bringing philosophy to the business world. Some of the country’s brightest brains shed some of their light on us.

LEARNING

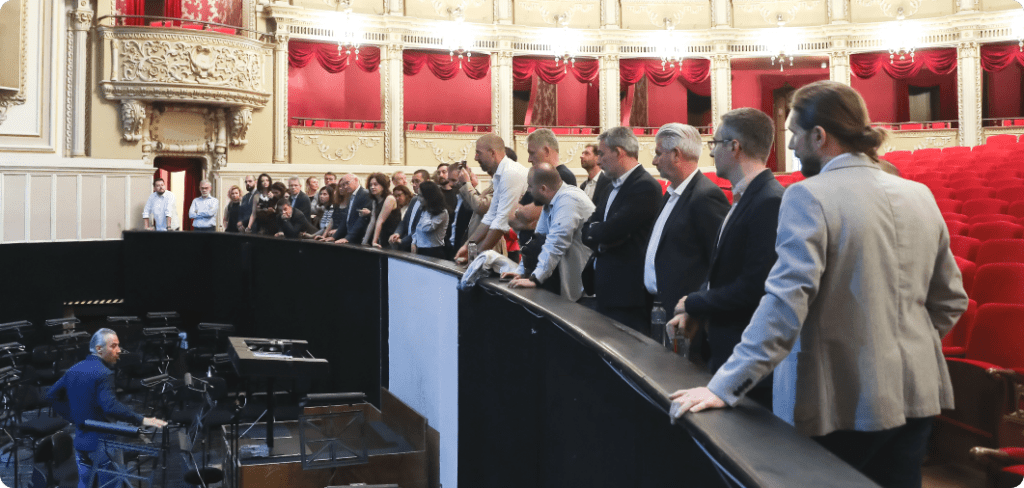

Panorama

A concept of 3 simultaneous meetings on different topics, with a maximum of 20 people per meeting, followed by a networking session to discuss topics ranging from business to culture.

LEARNING

Breakfast for Thought

Feed your thoughts by part-taking in quality discussion, over breakfast, based on an inspirational TED Talk video suggested by the Clubs’ Members.

EXPERIENCE

Power Lunch

The city’s most exclusive lunch, that starts by interviewing a Member followed by an open discussion.

RELATIONSHIP

Supported Events

Events organized by the Clubs’ Partners or third parties and supported by the Club. Offering benefits to Members such as VIP invitations and special offers/rates.

OTHER

Open Air Cinema

Annual July gathering, where Members and their spouses enjoy a secret movie under the starry night.

FUN & SOCIAL

Local and Abroad

Family trips in Romania and business delegations abroad, organized to offer a combination of great business opportunities as well as interesting cultural experiences. From Google’s APAC HQ in Singapore to Dubai’s Expo, up to Jordan’s Petra and Wadi Rum desert, we create together unforgetable experiences to remembers for years to come.

TRIPS

Wow Events

Experiential meetings with speakers from all domains that will leave you in awe.

EXPERIENCE